Reputation risk is no longer confined to isolated PR incidents or boardroom discussions. A company’s digital footprint is often the first and most lasting impression for stakeholders, customers, and search engines alike. As businesses expand across borders and diversify their market presence, they must evolve their approach to reputational risk management with a strong focus on online reputation management (ORM).

Online reputation is constantly shifting. Search visibility, review platforms, news coverage, and user-generated content drive it. Therefore, managing reputational risk in this environment requires more than traditional risk frameworks. It demands digital strategy, real-time responsiveness, and proactive ORM infrastructure.

When Risk Arises: A Constant Digital Presence

Reputation risk can surface at any time, without warning. It may begin with a critical review, a misleading article, or outdated content resurfacing on the first page of search engines. These digital moments have far-reaching consequences. They influence purchasing decisions, market value, investor confidence, and stakeholder expectations.

Additionally, the risk is amplified for companies operating across global markets. Cultural misunderstandings, regulatory scrutiny, and language variations can distort messages or misrepresent a brand’s intent. When amplified online, negative public opinion can lead to reputational damage that impacts business continuity.

In these scenarios, ORM becomes the first line of defense. It helps manage reputational risk by identifying threats early, neutralizing negative messages, and shaping the online narrative to reflect the company’s values and mission.

Defining Reputational Risk in a Digital Era

Reputational risk is the potential loss of trust, credibility, and stakeholder support from negative publicity or online exposure. In today’s environment, digital platforms often mediate and magnify that risk. A company’s online presence is its most visible and vulnerable asset.

For instance, review sites, social networks, third-party blogs, and archived media contribute to an interconnected web of public commentary. A major scandal isn’t required to shift public perception, but inaccurate or outdated search results alone can discourage customers and investors.

To counteract these risks, online reputation management strategies help manage exposure through sound risk management practices, such as:

- Monitoring mentions across platforms and media outlets

- Identifying emerging issues that may lead to reputational damage

- Ensuring the accuracy and freshness of content

- Publishing positive, branded narratives to improve visibility

- Responding appropriately and promptly to negative coverage

Together, these measures contribute to a safe and sound manner of conducting global business. They help firms prepare for reputational challenges before they arise.

Reputational Risk Management Across Borders

As companies enter new markets, reputational risk grows more complex. This is because each jurisdiction operates under its legal and regulatory framework for digital content, data privacy, and public discourse.

For example, the financial services industry must align with guidance issued jointly by national and international regulators. Foreign banking organizations, national banks, and federal savings associations are held to standards enforced by the OCC and other regulators.

According to the OCC bulletin and supervisory process, banks’ reputation risk is closely tied to their current standing, projected financial condition, and ability to meet stakeholder expectations.

Moreover, chief executive officers, senior management, and department and division heads are primarily responsible for implementing ORM tools in compliance with applicable laws. As Gardineer, Senior Deputy Comptroller, has stated, effective ORM is now a vital part of bank supervision policy.

ORM strategies should account for:

- Local search engine behavior and platform relevance

- Language accuracy and cultural nuance

- Regional laws concerning content removal and sensitive information

- Reputation repair protocols aligned with examining personnel and supervisory action standards

These considerations are essential to managing global ORM at scale and mitigating risks consistently and effectively.

The Importance of Real-Time Monitoring

Reputation risk applies to both emerging companies and legacy institutions. Monitoring public sentiment in real time allows businesses to detect shifts before they escalate.

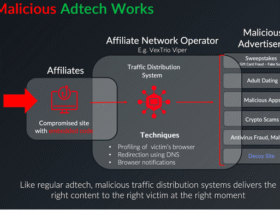

Negative publicity, coordinated online attacks, and misinformation campaigns can quickly impact shareholder value and customer retention. As a result, real-time ORM monitoring offers valuable insight to company leadership before negative messages dominate the conversation.

ORM platforms assist by:

- Tracking online perception across regions

- Detecting fake reviews and potential money laundering accusations

- Identifying top sources of reputational harm

- Guiding response strategies to mitigate damage

Real-time monitoring allows companies to stay ahead of emerging issues and act quickly to preserve trust.

Removing and Replacing Harmful Content

Part of ORM involves knowing how and when to remove harmful content. Companies must act to expeditiously remove false, outdated, or misleading references while respecting jurisdictional laws and standards.

Typical strategies include:

- Submitting takedown requests per platform policy

- Using suppression techniques to outrank harmful results

- Replacing content with positive, verified narratives

In the financial sector, covered savings associations and community banks must follow the OCC’s discontinuation notices. However, they must also understand that removing references is not a catch-all justification for avoiding accountability. Instead, ORM should function alongside internal compliance departments to ensure alignment with guidance issuances and regulatory expectations.

Aligning ORM With Stakeholder Expectations

Today, stakeholders expect integrity, transparency, and responsiveness. These values must be evident not only in boardrooms but also in what appears on search engine results pages.

Therefore, an effective ORM strategy includes:

- Messaging alignment across leadership teams and global offices

- Coordination between C-suite executives and regional division heads

- Responses tailored for various markets that still reflect corporate values

- Alignment with production quality standards and brand reputation benchmarks

Inconsistent communication, poor-quality goods, or a lack of local adaptation can harm digital perception and trigger negative public opinion. Businesses must stay aligned with stakeholders’ expectations.

Multinational firms rely on various tools to monitor and mitigate reputational risk effectively. These tools help analyze customer feedback, track brand sentiment, and identify emerging issues.

Popular platforms include:

- NetReputation

- Meltwater

- Brand24

- Google Alerts

To ensure consistent ORM practices across teams, internal protocols should reference these tools and include clear governance standards. They should also be included in training resources such as the Comptroller’s Handbook booklets.

ORM as a Strategic Business Imperative

Online reputation is directly tied to business success. Reputational damage can influence everything from employee morale to investor trust.

By integrating ORM into enterprise-wide risk management strategies, companies can:

- Operate in a safe and sound manner

- Respond quickly to scrutiny and regulatory challenges

- Maintain public confidence and stakeholder trust

- Avoid the reputational consequences of poor oversight

Furthermore, ORM allows companies to focus primarily on building long-term resilience arising from trust rather than reacting to issues after the damage has been done.

Final Thought: Reputation is Built Online

Reputation risk is real, evolving, and increasingly digital. Search engines shape perception. At the same time, customers share their opinions across platforms in real time.

ORM ensures your business is ready to respond, protect its digital footprint, and maintain credibility under pressure.

Whether you’re managing the reputations of oil companies, financial institutions, or technology brands, the core principles remain the same: transparency, vigilance, and adaptability.

To manage reputational risk effectively, multinational firms must treat ORM not as a reactive tool but as an essential part of modern risk management and long-term business strategy.